COMPREHENSIVE ASSOCIATION WITH INVESTORS

ORGANIZATION OF PROFESSIONAL FRE PROTECTION FORCE

* Before investment

» Free support for carrying out business establishment procedures; dossier of application for an investment registration license at the Department of Planning and Investment of Long An Province/ Management Board of Economic Zones of Long An Province.

» Apply flexible investment attraction policies, suitable to the needs and customers (in terms of prices, fee schedules, divergences and payment conditions).

» Investment consultancy, procedure support in a simple and fast process.

» Advising and supporting bank loan procedure.

» Apply flexible investment attraction policies, suitable to the needs and customers (in terms of prices, fee schedules, divergences and payment conditions).

» Investment consultancy, procedure support in a simple and fast process.

» Advising and supporting bank loan procedure.

* After investment

» Design consultancy, construction, guidance support for investors to carry out procedures for applying for construction permits, environmental permits, plans and design dossiers for fire protection, etc.

» Support procedures for issuance of certification of Land use right (Red Book)

» Support to apply for a project ownership certificate (Pink book).

» Provide utility services.

» Take care of customers and regularly organize community activities.

» Support and take care of workers' lives: building accommodation houses, commercial services, healthcare, kindergartens, schools, developing connected residential clusters.

» Support procedures for issuance of certification of Land use right (Red Book)

» Support to apply for a project ownership certificate (Pink book).

» Provide utility services.

» Take care of customers and regularly organize community activities.

» Support and take care of workers' lives: building accommodation houses, commercial services, healthcare, kindergartens, schools, developing connected residential clusters.

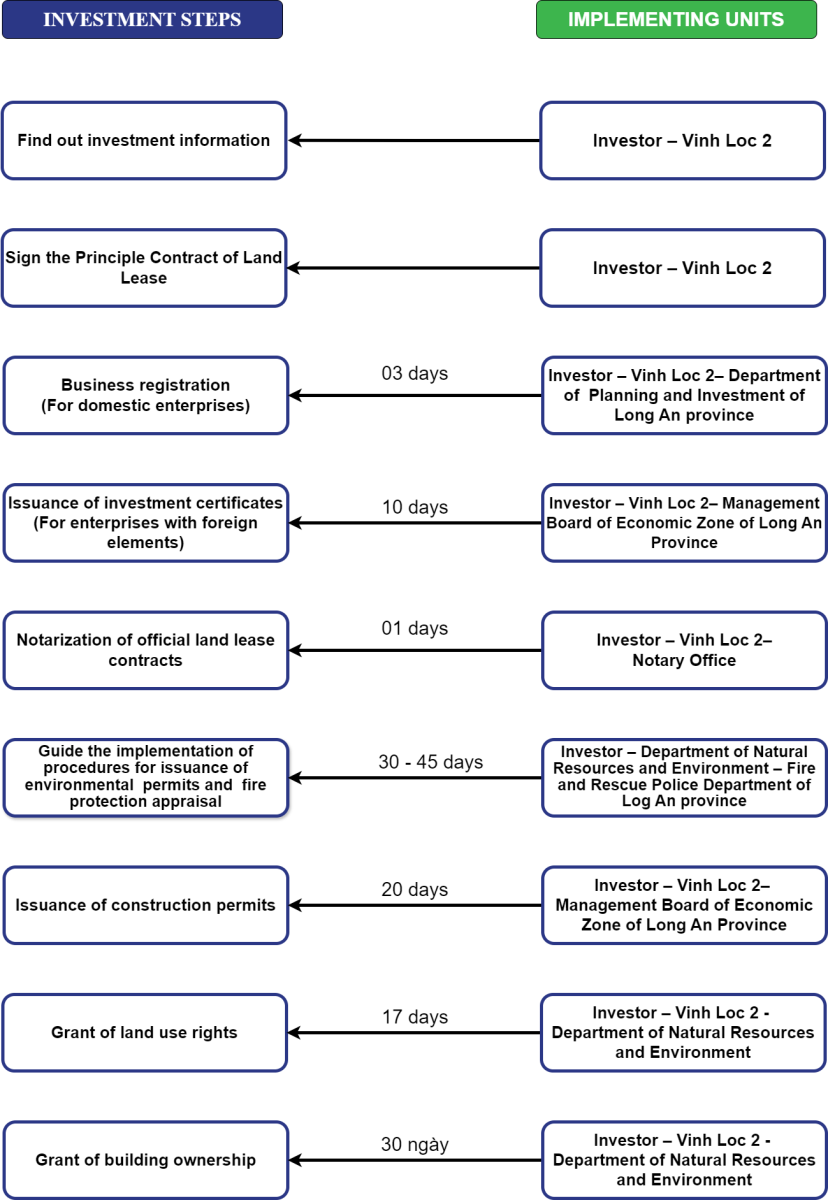

SCIENTIFIC AND EFFECTIVE INVESTMENT PROCESS

INVESTMENT INCENTIVE POLICIES

| No. | Content | Policy | Industrial Zone | Notes |

|---|---|---|---|---|

| 1 | Corporate Income Tax | Implement CIT exemption and reduction according to Decree No.118/2015/ND-CP effective from 27/12/2015 | Exempted | Enjoy investment incentives of the Government with CIT rate: 20% 2 years tax exemption and 50% reduction of payable tax in the next 04 years for income from implementing new investment projects in Vinh Loc 2 industrial zone. |

| 2 | Export | Import duty exemption for imported goods as prescribed in Article 12 of Decree No. 87/2010/ND-CP dated 13/8/2010. | Exempted | |

| 3 | Import | Imported and exported goods are exempt from duty according to Decision 72/2013/QD-TTg dated by the Prime Minister and Circular 109/2014/TT-BTC dated 15/8/2014 of the Ministry of Finance. | Exempted | 05 years exemption from the date of commencement of production for projects on the list of unproduced domestic raw materials, supplies and components imported for production of investment projects in border-gate economic zones. |

| 4 | VAT tax | Exported products and goods | According to VAT law | |

| Products and goods exported or sold into industrial zones (consumption outside the territory of Vietnam). | 0% | |||

| Mechanical products, molds, computers and accessories, electrical cables, basic chemicals, tire tattoos, printing paper, pesticides, fertilizers, medical equipment, examination and treatment equipment, teaching equipment, children's toys, agro-forestry-fshery materials, food, handicrafts, etc plywood, prefabricated components, steel, animal feed etc. | 5% | Circular No. 219/2013/TTBTC dated December 31, 2013 of the Ministry of Finance | ||

| Mechanical and electrical goods, electronics, chemicals, cosmetics, fabrics, garments, embroidery goods, leather goods and leatherettes, ceramics, glass, wood, building materials, milk, dry food, beverage. | 10% |

.jpg)

.jpg)

.jpg)

.jpg)